39+ what does it mean to recast a mortgage

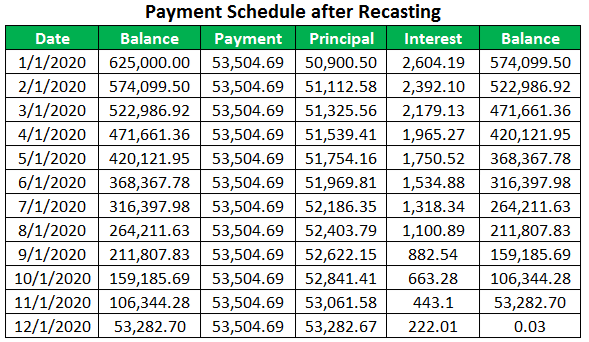

Web Recasting a mortgage means paying an extra lump sum of your principal amount for a house. The lender then reamortizes.

Mortgage Recast Definition Calculation How It Works

How Much Interest Can You Save By Increasing Your Mortgage Payment.

. Web What Is A Mortgage Recast. Your new lower required monthly principal and. Web How to Request a Mortgage Recast.

Essentially the recast is a second down payment and can be. A recast mortgage is a process of reevaluating monthly mortgage payments by taking the loans balance and dividing it by the remaining months. Must have made a minimum of two payments on the current loan.

That means you would. To put that in. Heres how the calculator works.

Compare Apply Directly Online. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. A mortgage recast also called a mortgage reamortization allows a borrower to put down a lump-sum payment toward the principal.

Web A mortgage recast is when your mortgage company reamortizes your loan based on the new principal amount after you make a lump-sum payment. The steps you need to take for a mortgage recast are pretty straightforward. Web You are usually required to put at least 5000 toward the principal or a percentage toward the loan balance Brown says such as 10.

Web Instead of paying off your loan sooner it may make sense to recast your balance over the remainder of your original loan term. Web A mortgage recast also called a loan recast is when you make a lump-sum payment towards the principal balance on your mortgage. Web A mortgage recast is when you make a large one-time payment to reduce your mortgage balance and your lender recalculates your monthly payment as a result.

You might not be able to. Web A fee to recast usually a couple to few hundred dollars. Web A mortgage recast is when a lump-sum is paid toward the principal balance of a loan to lower monthly payments and save interest.

But you can only recast a mortgage after you. With a refinance you are looking at a whole lot of fees. Web A mortgage recast restructures your loan so that the remaining balance is spread out over the rest of the loan term.

No more than one recast per year. Web A mortgage recast is when a lender recalculates the monthly payments on your current loan based on the outstanding balance and remaining term. Web Call your current lender to find out their fee.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Typically the types of mortgages that can be recast are conventional loans under the conforming limits but not government loans VA FHA USDA. Web What Is A Recast Mortgage.

If you have 50000 to pay down on a 300000 mortgage balance on a 30-year fixed. These include an appraisal fee of around 300 to 500 and closing costs between 1800 and 4000. Here are pros and cons.

Review your current mortgage status. When you purchase a home.

Verification Letter Examples 39 In Pdf Examples

Mortgage Recast Lower Your Mortgage Payment Without Refinancing Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Az Real Estate 05 11 2014 By Localiq Issuu

Mortgage Recasting Should You Consider It Quicken Loans

Why You Should Consider A Mortgage Recast Nerdwallet

:max_bytes(150000):strip_icc()/WhatHappensIfYouMakeaLump-SumPaymentJan.32022-583f76791c154af39e17a0fb0375e0c1.jpg)

What Is A Mortgage Recast

Mortgage Recasting 101 How It Works And What It Does

Mortgage Recast Definition How It Saves You Money

What Is A Mortgage Recast Moneytips

Mortgage Recast What Is It And How To Do It Experian

Recast Mortgage Explained Reamortize Mortgage Guaranteed Rate

Xwqgog0dbwmeqm

Free 39 Sample Release Forms In Pdf Excel Ms Word

Property In Saket Nagar Bhopal 39 Real Estate Property For Sale In Saket Nagar Bhopal

:max_bytes(150000):strip_icc()/ScreenShot2019-01-15at3.35.40PM-5c3e455dc9e77c0001915edd.png)

Mortgage Recast Differences From A Refinance

Mortgage Recasting What It Is And How It Works Bankrate

:max_bytes(150000):strip_icc()/GettyImages-1294509749-8c965632914d4352944e82cf2647e884.jpg)

What Is A Mortgage Recast